Another day, another dollar — saved, that is.

A viral internet challenge has emerged as the hot new way to stockpile cash for the future, and some super-savers have collected over $5,000.

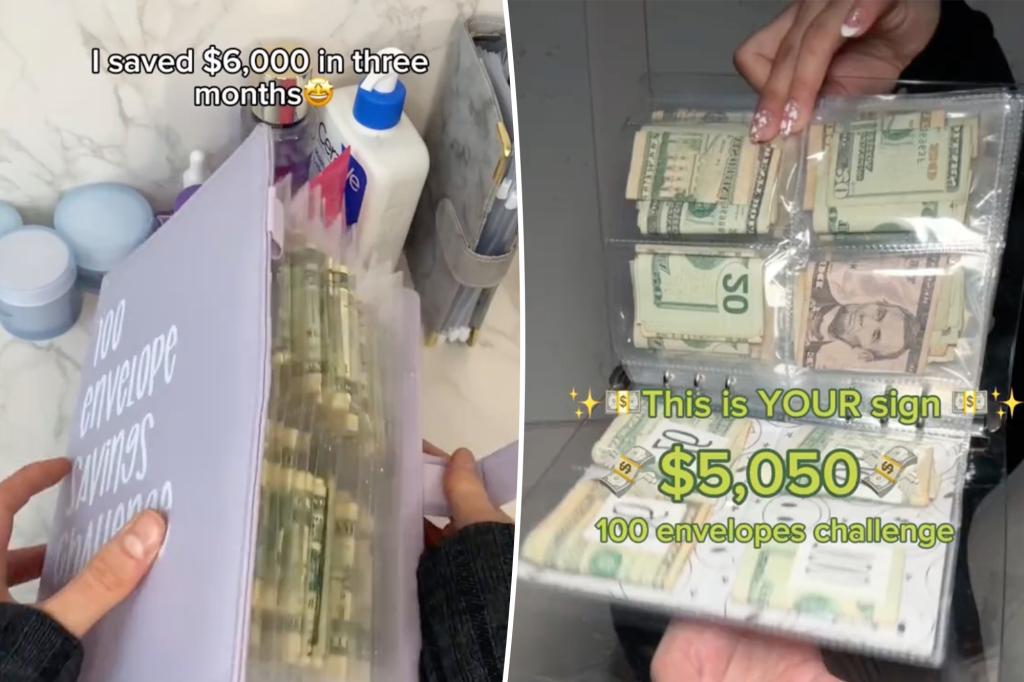

The “100 Envelope Challenge” is exactly what it sounds like: starting with 100 envelopes numbered 1 to 100, budgeters deposit the dollar amount that corresponds with the envelope number every day. For example, $1 on envelope no. 1, $2 on no. 2, and so on.

In less than four months, you should have $5,050 put aside.

“Like the other viral money-saving methods, there’s gamification and a sense of fun added to something you should already be doing,” Jack Howard, Ally Financial’s head of money wellness, told HuffPost.

“When saving money becomes a ‘challenge,’ it can be a motivator, especially when it results in $5,050 of cash.”

The method — a “more approachable” way to save money, Courtney Alev, a consumer financial advocate at Credit Karma, told the outlet — was originally made popular by a creator known simply as Milly (@budgetwithmilly) on TikTok, where she educates her 45,000 followers on how to be economical.

Challenge participants may stow away money in chronological order, while others might pick a random envelope on a given day. Either way, you’ll end up with the same end result: a boatload of savings.

“Methods like the 100 envelope challenge can help because it turns saving into a game, and you have a clear path and goal to follow, which reduces the mental load of planning and staying focused,” budgeting expert Andrea Woroch told HuffPost.

Of course, saving money is a net positive habit, but the envelope challenge is especially beneficial “for those who are more visual” — they can see the dollar bills that they are saving and not spending rather than swiping a plastic credit card, said Alev.

“You have a daily goal that requires thoughtful planning to execute,” Howard said. “Knowing you need to meet the goal may stop you from spending on things you really don’t need and have historically purchased out of habit.”

But the experts warned not to deposit so much cash that it disrupts your ability to pay off your credit card bill or result in an account overdraft.

It might not be “realistic” to put away as much cash as the envelopes require, “especially when you’re entering the double digits,” Woroch noted. Luckily, no one is holding you accountable except for yourself, so she recommends customizing the dollar amount to fit your budget.

“Ultimately, you’re still saving ― and saving more than if you didn’t participate in the challenge at all,” she added.

Not to mention, you’ll likely be taking multiple visits to the nearest ATM, and all that cash will require a safe hiding place.

“At the end of the day, it’s another fad that doesn’t promote a sustainable saving practice ― and the $5,050 isn’t guaranteed,” Howard said, noting that the challenge won’t work for necessarily everyone.

“Some might find it difficult to remember to complete the challenge each day and fall behind on the goal to save in 100 days.”

She recalled once trying her hand at a similar savings method, using a wallet that required a deposit of $40 per day, but often found herself reaching for the bills when ordering pizza or acting as “the tooth fairy” for her daughter.

Howard would prefer to digitize the challenge, encouraging participants to transfer a dollar amount from a checking to a savings account every day.

That way, you get the best of both worlds: you’re saving money safely and raking in the compounding interest that accompanies putting money in the bank.

“A high-yield savings account will help your money grow over time, even after the 100-day challenge ends,” she explained. “We’re currently in a competitive rate environment which is great for saving.”

TikTok is a treasure trove of financial advice and money-centered trends — “girl math” and “loud budgeting” among the most recent — as many creators undertake seemingly impossible savings challenges, like a “no spend” year.

But social media is often a highlight reel, and there’s no way to know about the financial reality of the individuals participating in trends like the envelope challenge.

“It’s important for people to understand that these viral moments are typical of social media and don’t always show the low moments in life,” Howard said.

“While you might come across someone who easily completed the challenge, there are multiple people who found it difficult to keep up with or had an unexpected expense that derailed them.”