(Bloomberg) — Almost all of Britain’s growth in the past five years has been driven by just two superstar sectors, laying bare the task facing Prime Minister Keir Starmer to revive swathes of the economy.

Most Read from Bloomberg

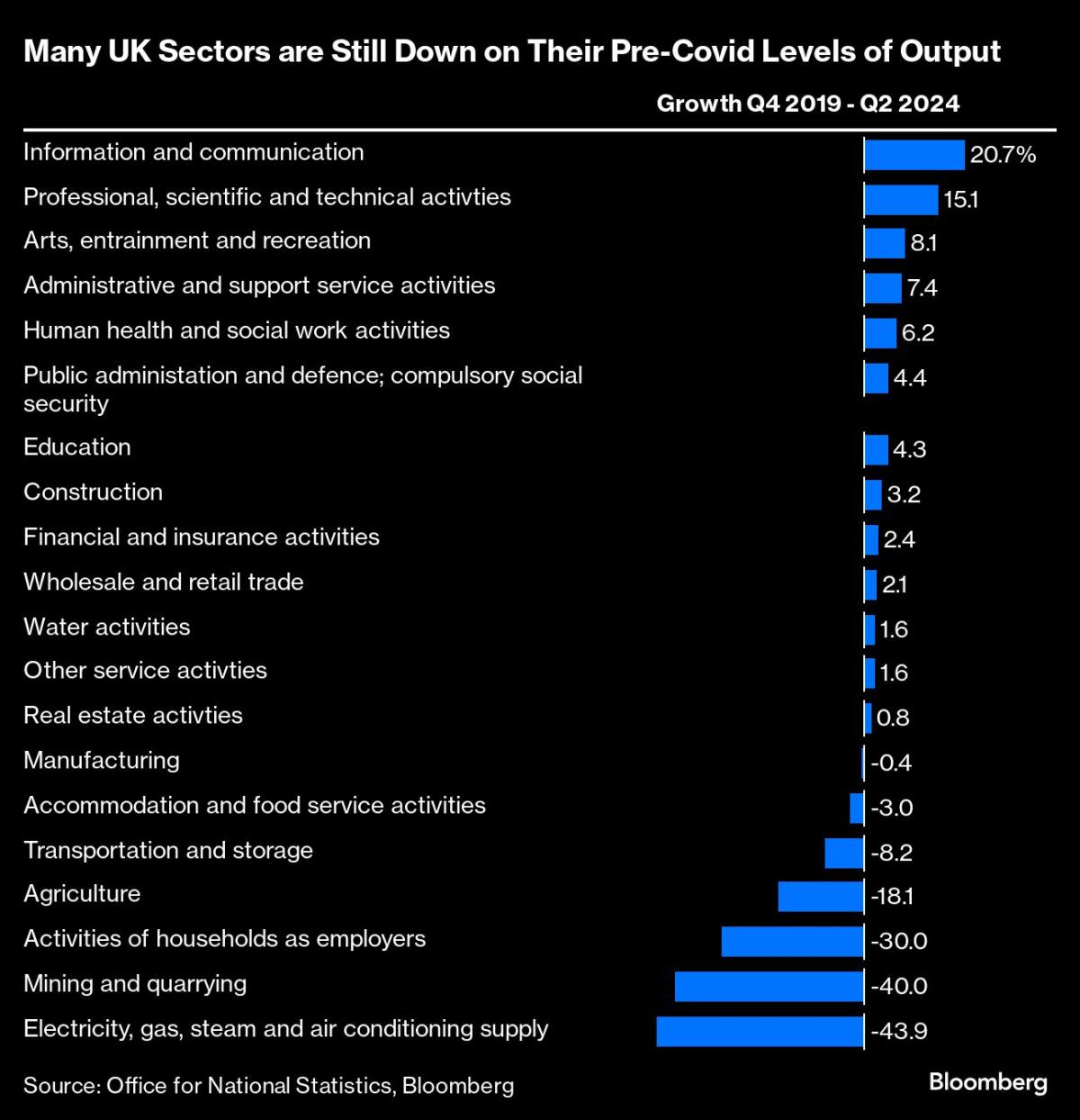

Bloomberg analysis of official data shows an outsized contribution from technology and science-based industries is concealing a two-speed recovery, where sectors from hospitality to manufacturing are struggling to expand.

A third of sectors accounting for almost 20% of gross value added are still below their 2019 levels of output almost five years after Covid struck, with others including real estate and construction barely higher. Instead, Britain has relied on two — information & communication and professional, scientific & technical activities — to power its patchy performance on the back of a wave of innovation.

The figures illustrate the mountain Starmer has to climb to deliver on his pledge to make Britain the fastest-growing economy in the Group of Seven. That hinges on the strongest performers continuing to boom, and the many misfiring sectors picking up steam.

Potentially at stake is Labour’s grip on power. Its landslide election victory in July — and the rise of the far-right Reform UK party — was partly the result of the Conservatives’ failure to make good on its pledge to “level up” poorer regions of the country that are more reliant on traditional industries.

Chancellor of the Exchequer Rachel Reeves promised at the Labour Party conference this week to deliver a “budget for economic growth” on Oct. 30. Since the end of 2019, the UK economy has been outpaced by every other G-7 nation except Germany.

However, she is up against a recovery that is running out of steam, in part due to Labour’s dire warnings about the public finances and the prospect of tax hikes.

While figures due out on Monday are expected to confirm the economy grew a healthy 0.6% in the second quarter, more recent indicators suggest the pace has slowed to around 0.3% a quarter, as forecast by the Bank of England. GDP stagnated in July for the third month in four, while a key purchasing management survey showed activity cooling in September.

The sectoral analysis covers a tumultuous period for Britain when Brexit, Covid, worker shortages and the worst bout of inflation in decades damaged some firms but technological advances lifted others.

Information & communication and professional, scientific & technical activities contributed almost 90% of the 2.8% overall expansion in GVA since the end of 2019, with the former sector growing over 20%. There has been particular strength in telecommunications, computer programming, science research and development, and certain professional services, such as law and accounting.

“The tech sector has seen strong demand for services such as AI, automation, data analytics, cloud computing, and cybersecurity,” said Martin Sartorius, principal economist at the Confederation of British Industry. “Firms across various industries have been investing in these technologies to enhance efficiency, security, and decision-making capabilities.”

The UK has been highlighted as likely to be one of the biggest growth winners from AI taking off given its dependence on professional services.

Agriculture, a sector heavily affected by Brexit, is one that has struggled, suffering a sharp plunge in output from fishing in particular. Manufacturing, mining and quarrying, and hospitality were among the other sectors to shrink since 2019.

“We are seeing an uneven recovery, with an overreliance on services to drive overall economic activity, while other sectors struggle,” said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales.

“Global factors have also played a part with strong international demand for professional services, while firms exporting goods to the EU continue to struggle with post-Brexit trade frictions,” he said.

The prospects of firms in these struggling industries are being shaped by the new Labour government.

While hospitality firms have been hamstrung by worker shortages in recent years, Labour’s promise to clamp down on migration may keep the labor market tight. Manufacturers will also be watching government policy closely, as ministers draw up plans for a new industrial strategy that may be more interventionist.

There have also been warnings over Labour’s energy plans affecting oil and gas production — which is counted in the mining and quarrying sector. It plans to boost the rate of the Energy Profits Levy, and is stopping new oil and gas licenses in the North Sea.

–With assistance from Andrew Atkinson and Irina Anghel.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.