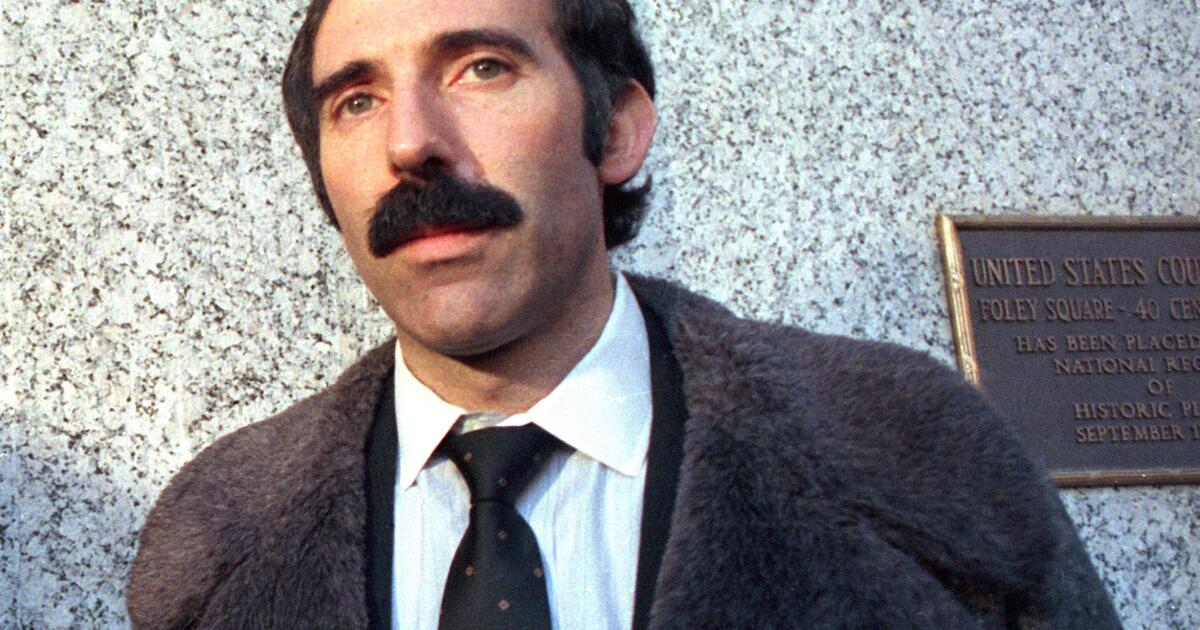

Paul A. Bilzerian was indicted Thursday by a federal grand jury in California for allegedly dodging a decades-old judgment owed to the U.S. Securities and Exchange Commission that now exceeds $180 million.

Prosecutors say Bilzerian, described as a corporate takeover specialist, avoided paying the judgment even as he ran Ignite, a cannabis and lifestyle brand company purportedly helmed by his social media influencer son, Dan Bilzerian.

The elder Bilzerian allegedly funneled millions of dollars of his assets through shell companies to fund Ignite, whose investors he allegedly cheated, the Justice Department announced Friday.

“On paper, Ignite’s CEO was Bilzerian’s son D.B. — a professional poker player who gained notoriety on social media for his glamorous and ostentatious lifestyle,” the U.S. attorney’s office in L.A. said in a news release. “In fact, Bilzerian exercised de facto control of the company.”

To avoid paying the SEC judgments, prosecutors say, Bilzerian falsely represented that he was indigent.

The indictment charges Bilzerian, 74; Ignite International Brands, a Canada-based cannabis company; and Scott Rohleder, Bilzerian’s longtime accountant, with conspiracy to defraud the U.S., conspiracy to commit wire fraud and securities fraud and four counts of wire fraud.

The younger Bilzerian has not been charged and is identified only by his initials in the indictment.

Lawyers for the defendants could not immediately be reached for comment. Arraignment is set for Oct. 28.

“This indictment alleges a long-running pattern of criminal behavior to avoid a regulator’s judgment, mislead investors, and cheat the IRS,” U.S. Atty. Martin Estrada said in a statement.

The latest charges trace to 1989, when Bilzerian was convicted of securities and tax-fraud violations related to three failed takeover attempts. He was sentenced to four years in federal prison, but ultimately served 13 months.

The SEC then brought a civil action against Bilzerian and obtained judgments totaling more than $62 million in 1993. Since then, prosecutors say, Bilzerian has evaded enforcement.

In 2000, a federal court found Bilzerian in contempt and appointed a receiver to collect his assets, according to the U.S. attorney’s office in Los Angeles. The SEC recovered only about $547,000.

Now, with interest, the judgments exceed $180 million.

Prosecutors allege that, from December 2018 to September 2024, Bilzerian, Rohleder and Ignite conspired to impede the SEC from collecting on the judgments. Bilzerian allegedly operated numerous shell companies, while concealing his interest in and control over those companies.

Bilzerian and Rohleder allegedly oversaw Ignite’s operations, strategy, marketing and fundraising, and held daily management meetings, according to the indictment. Bilzerian also had influence in decisions to hire and fire Ignite’s executives and members of its board of directors

After Bilzerian learned federal law enforcement knew of his involvement in Ignite, the company issued a news release characterizing Bilzerian and Rohleder as “unpaid consultants,” according to the indictment.

Prosecutors also allege that the defendants misled Ignite’s investors by inflating sales figures.

If convicted of all charges, Bilzerian and Rohleder would face up to five years in federal prison for each conspiracy count and up to 20 years for each wire fraud count. Rohleder would face up to three years for each tax fraud count.

On Friday, the SEC filed civil charges against Bilzerian, Rohleder and Ignite in connection with the facts alleged in the criminal case.