Many Americans are struggling to keep up with their monthly bills, with roughly 40% of consumers reporting that it’s “somewhat” to “very difficult” to pay their usual bills with the rising cost of living, according to U.S. Census Bureau data. Things might get even more difficult now that student loan payments have resumed and summer is approaching — which often comes with increased child care and travel costs.

Read Next: 5 Unnecessary Bills You Should Stop Paying in 2024

Check Out: 9 Things You Must Do To Grow Your Wealth in 2024

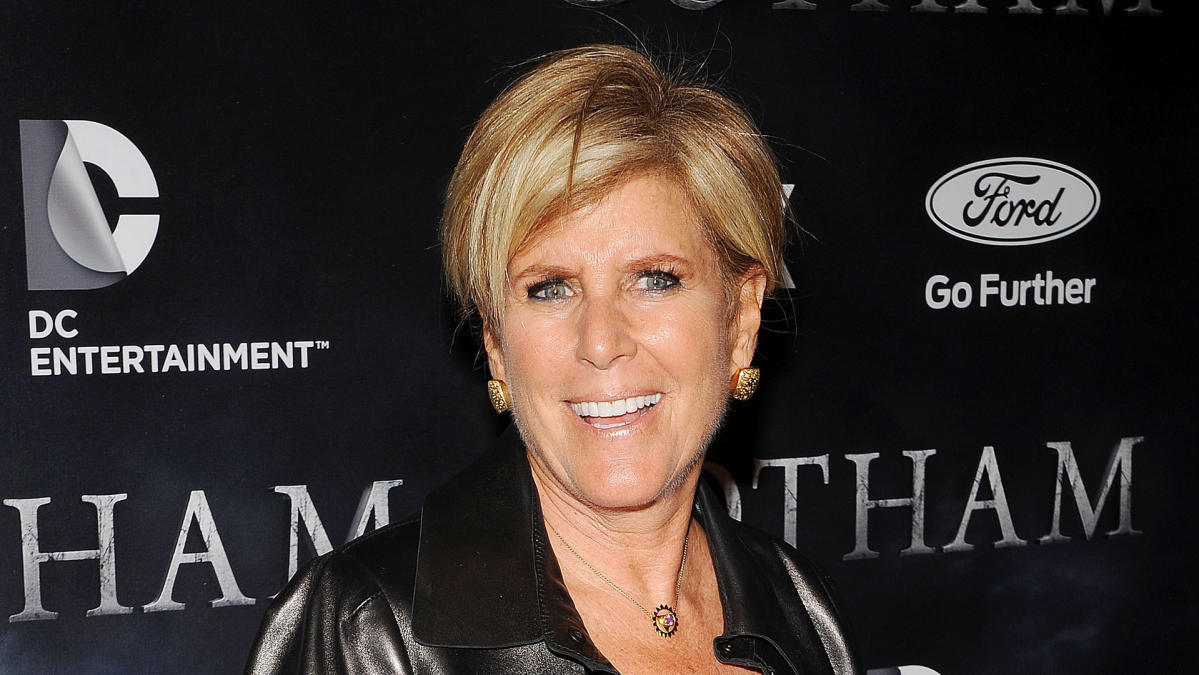

While you should ideally pay all of your bills, Suze Orman, host of the “Women & Money” podcast, said there is one bill you should always prioritize.

Earning passive income doesn’t need to be difficult. You can start this week.

Don’t Neglect Your Student Loan Payments

After having student loan payments paused for so long due to the pandemic, they resumed in the fall of 2023. This was a challenge for many to figure out how to reintroduce them into their budgets — but you can’t just ignore your payment and hope it goes away.

Trending Now: Here’s the Income Needed To Be in the Top 1% in All 50 States

“It should be a priority,” Orman told GOBankingRates. “People need to remember to not put off paying your student loans. It’s not going away and it should be the first monthly bill you pay. It’s not going to disappear. You can’t bankrupt your student loan.”

How To Fit Student Loans Back Into Your Budget

“Make a plan/budget that works so you can pay [your student loans] each month,” Orman said. “Give up eating out or other unnecessary expenses so you can start making your payments.”

Orman notes that under President Joe Biden’s new income-driven repayment (IDR) plan, called the Saving on a Valuable Education (SAVE) Plan, your payments can be significantly lower than they were before the payment pause. Under the new plan, single borrowers earning $32,800 or less and families of four earning $67,500 or less will no longer need to make any payments. Borrowers earning more than these amounts will save at least $1,000 per year compared to the current income-driven repayment plans, according to StudentAid.gov.

“With the new guidelines, many people’s payments will be cut in half,” Orman said, “making it easier for people to make their monthly payments.”

Gabrielle Olya contributed to the reporting for this article.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman: This Is the First Bill You Need To Pay Each Month