Home Buying

The bad news: They broke records in July. The good news: The increases were modest and are less than what buyers paid in June.

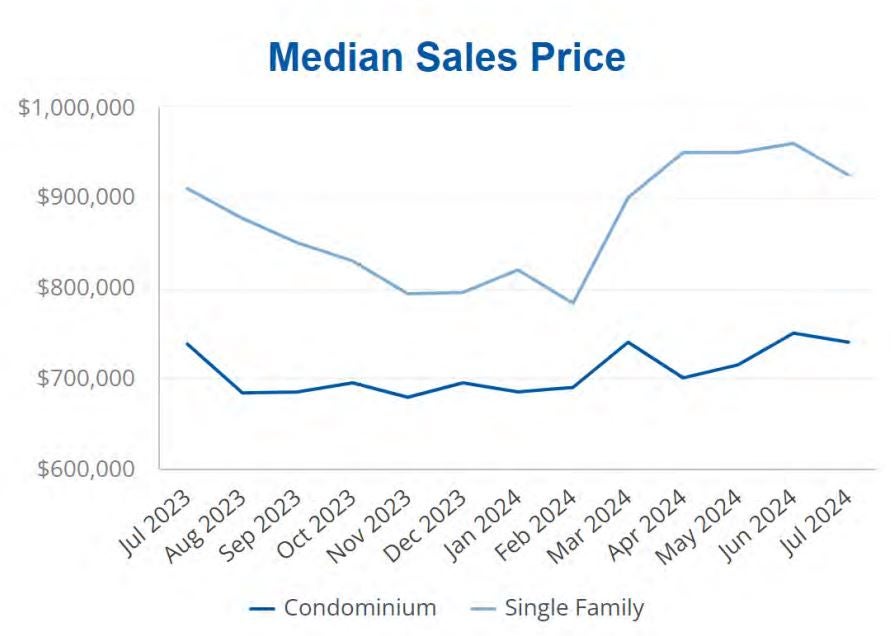

The median sales prices for single-family homes and condominiums in Greater Boston broke records for July but were less than what buyers paid in June, according to a report the Greater Boston Association of Realtors released Wednesday.

The median sales price for a single-family in July was $910,000 — $15,000 more compared to July 2023 but $50,000 less than the June 2024 median.

In the condo market, buyers paid a median of $740,000 in July. That’s $2,000 more than they shelled out in July 2023 and $12,000 less than compared with June 2024.

Buyers are enjoying more purchasing power, and “there is some evidence that prices may have reached their ceiling, at least in the near term,” according to the report.

“What we are experiencing at the moment is not a price correction, but rather a softening in prices,” Jared Wilk, the association’s president and a broker with Compass in Wellesley, said in the news release. “With the prime selling season behind us, we’re seeing fewer bidding wars, more offers under asking price, and homes that are taking longer to sell. As a result, sellers have become more flexible, with some agreeing to price reductions in order to sell.”

“Prices also have eased a bit from their peak over the past month, which suggests buyers are finding more room for negotiation,” Wilk added, “and that’s giving many a renewed sense of optimism as we approach the fall market.”

Evidence may indicate that prices are capping out, but the median sales price year-to-date is still 7.1 percent higher than at this point in 2023, according to the report.

Condo buyers are paying $189 more per square foot than single-home purchasers, according to the report — $630 compared with $441.

Mortgage rates giveth and taketh away

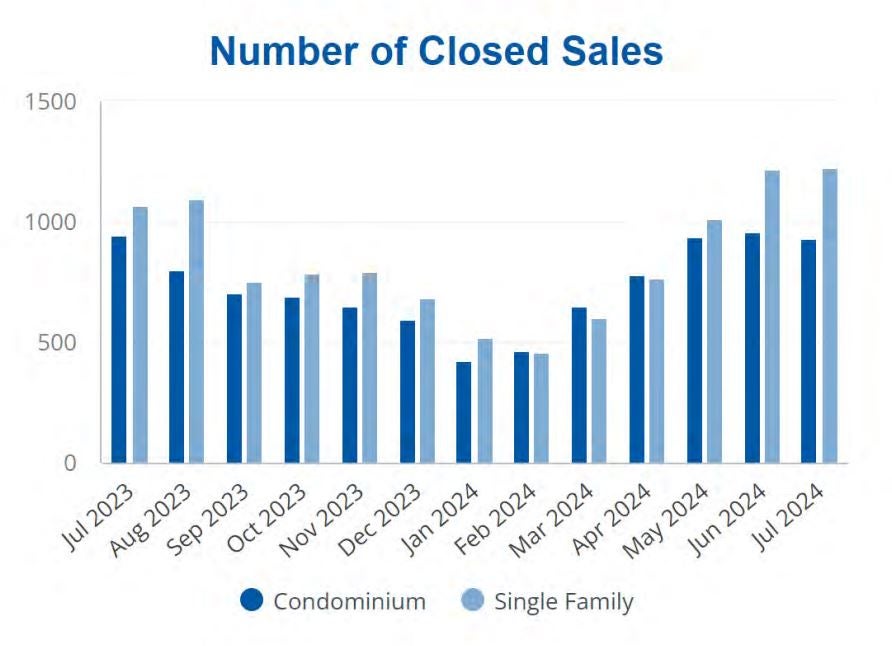

Mortgage rates that have eased from a high of 7.22 percent on May 2 may have played a role in the nearly 15 percent jump in sales and the 10 percent increase in local listings year-over-year in July in the single-family home market.

The available inventory in July was 1.2 months — a disappointing number that suggests that some sellers who don’t want to trade their low mortgage rates for ones in the mid-sixes — are still hesitant to list. Many experts agree that at least a five-month supply of inventory is a healthy market. High mortgage rates also relegate some buyers to the sidelines as the costs ratchet up, siphoning their buying power.

“There’s no denying the fact that sales activity continues to lag behind historic norms, but it’s also worth noting that last month was the busiest one we’ve had for home and condo closings in more than a year,” Wilk said. “Buyers have a larger selection of homes to choose from than they did last summer, and with mortgage rates lower than they were this spring, the market has become increasingly more inviting to those looking to buy.”

Condo sales were down 1.2 percent, but the “months supply” of inventory rose from 1.7 in July 2023 to 2.1 last month.

“Although buyer demand has been slowed by higher interest rates, it continues to outpace the supply of homes for sale,” Wilk said, “and that imbalance has kept upward pressure on selling prices and allowed for continued price appreciation.”

Economic forecasts call for mortgage rates to continue to fall, but not below 6 percent. The average rate ticked up last week to 6.49 percent.

Massachusetts home prices soar

The median sales price for a single-family home in the state jumped 6.6 percent to $650,000 in July, according to a report The Warren Group, a data analytics firm, released Tuesday.

That’s a record for the month, but home prices are losing momentum, according to Cassidy Norton, associate publisher and media relations director for the group: “Interest rates are more than double where they were two years ago, and I’m certain prices would be even higher without those changes. That does lead to a lack of inventory that may have abated price gains somewhat. Unfortunately, the lack of inventory will continue to be the biggest factor driving prices for the foreseeable future.”

Sales were up a modest 0.8 percent.

In Arlington, the median sales price of $1,142,500 for a single-family home in July reflects more than an 11 percent decrease. In Needham, the median sales price was $1,408,000, a jump of 3.9 percent, according to the report.

In the condo market, sales were up 3.2 percent, and the median price rose only 1.8 percent year over year to $565,000.

“The median condo price also reached a new high for July, but prices were down moderately from the previous month,” Norton said. “This could be an early indicator that condo prices are starting to plateau.”

In Quincy, the median sales price for a unit was $485,000, a drop of nearly 5 percent. In Malden, the median sales price for July was $425,000, an increase of 6.3 percent.

Check out the breakdowns by town and county and the recent sales list from The Warren Group.

Address newsletter

Get the latest news on buying, selling, renting, home design, and more.