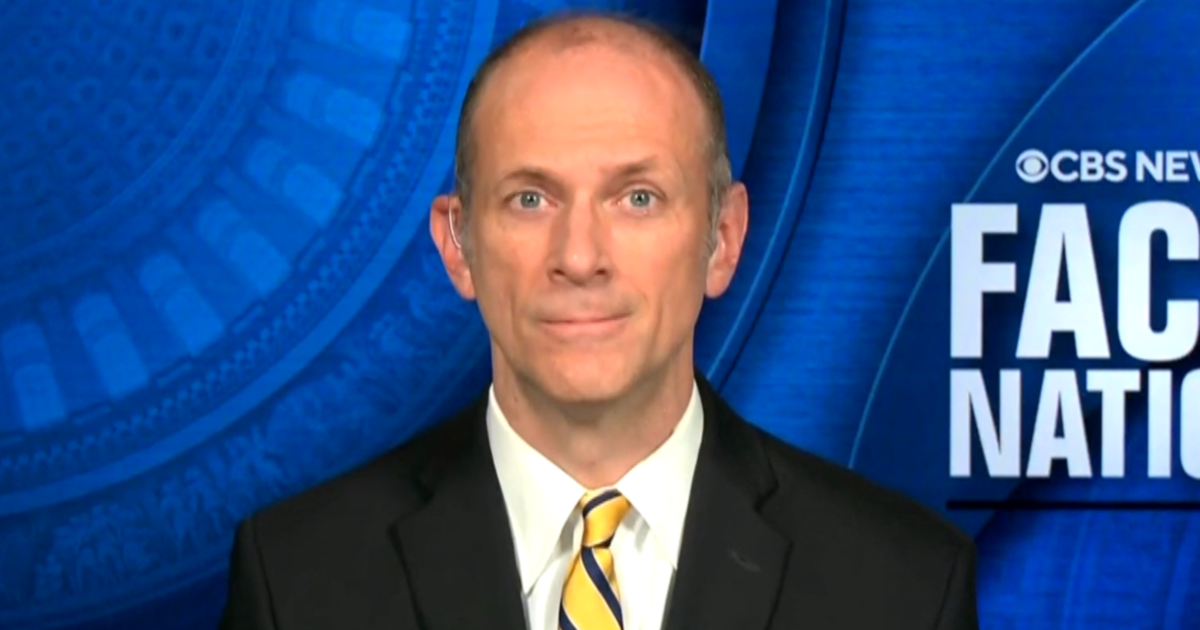

The following is a transcript of an interview with Austan Goolsbee, president of Federal Reserve Bank of Chicago, on “Face the Nation with Margaret Brennan” that aired on Aug. 18, 2024.

MARGARET BRENNAN: We go now to Austan Goolsbee, the President and CEO of the Federal Reserve Bank of Chicago. Before taking on that apolitical role he had previously served in the Obama administration. Good morning to you.

AUSTAN GOOLSBEE: Hi. Great to see you again, Margaret.

MARGARET BRENNAN: So, President Goolsbee, Barron’s had a piece yesterday saying that the most consequential event this fall won’t be the U.S. election, it won’t be a war in the Middle East, it will be the Federal Reserve’s decision in September to lower interest rates for the first time in more than four years. Is that a certainty? Do you think it is time to lower rates?

GOOLSBEE: I don’t think it’s a certainty, and I- I don’t like, as you know, tying our hands ahead of time when we got a lot of data to come in and everyone on the committee is going to get to speak their piece, and it’s a- it’s a committee decision. We try, as the Fed, to make clear what our reaction function is, if you want to call it that. I invite everybody to go read the statement of economic projections, which every -in our- in our world, colloquially, we call the dot plot, where we outline every quarter, what do the members of the committee individually think will be the appropriate policy for each of the next three years, and what economic conditions do they expect to correspond with those? And we’ve been making clear for quite a while what economic conditions would be appropriate for us to cut rates, for us to hold rates where they are, and things like that. And I do think that the- we set an interest rate more than a year ago at a high level because we were fighting inflation, and the economic conditions today are very different than they were when we set the rate at this level.

MARGARET BRENNAN: So, interest rates and supply of housing impact what consumers end up paying for shelter. What is going to bring down shelter costs? Because that was such a big part of the inflation number that we just saw.

GOOLSBEE: Well, look, Margaret. You know as much as anybody about this, the biggest puzzle that we’ve seen in the inflation numbers has been the persistently high inflation rate on shelter and housing, and we- we can get a little mixed up, because that official measure is very- is a very lagging indicator of what the actual housing price conditions are on the ground. So our puzzle has been why the market rents inflation rate has come down, but that hasn’t yet been reflected into the official backward looking housing inflation. So one of the things that’s going to bring it down is just- we’re going to keep getting more data, and that’s going to get incorporated into the official series. But the second is, the interest rate, how it works, how the Fed stabilizes the Business Cycle, is when it tightens the screwdriver, the interest rate goes up and the demand for housing goes down and so some of those interest rate sensitive sectors of the economy, weakness in that is partly how the monetary transmission takes place and the inflation rate softens. And it’s worth noting that last year, inflation fell by almost as much as it has ever fallen in a single year in the United States, and that happened without a recession which is unparalleled. So we’re hoping to continue some of that as we go through ’24.

MARGARET BRENNAN: That’s part of the delicate dance the Fed is doing here. Bank of America’s CEO was with us last week on- on “Face the Nation,” and he told us his economists are no longer predicting a recession, but he did say there’s a risk if the Fed does not start to move rates down. Take a listen.

(BEGIN SOUND ON TAPE)

BRIAN MOYNIHAN: They’ve told people rates probably aren’t going to go up, but if they don’t start taking them down relatively soon, you could dispirit the American consumer. Once the American consumer really starts going very negative, then it’s hard to get them back.

(END SOUND ON TAPE)

MARGARET BRENNAN: He also said corporations aren’t using their lines of credit due to the higher rates. What do you make of that caution?

GOOLSBEE: I think it’s a valid caution when rates are this high, if you take measure of how tight the Fed is as just a What’s the rate minus what’s the inflation rate, when you set a rate high like we have, and hold it there while inflation falls, you’re actually tightening. Credit conditions are getting tighter. And when we go out in the Chicago seventh district, you can hear from business leaders and community leaders around the district that credit conditions on them are tight when your bank loans and what the rates they pay and credit availability is tight. So I think he’s right. I think you got to have a caution when you see small business defaults rising like they have been rising. When you see consumer credit delinquencies, credit card delinquencies rising like they’ve been rising, those are warning signs. Now there’s, there’s some others that are more positive, but they’re, they’re definitely of concern. And if you keep too tight for too long, you will have a problem on the employment side of the Fed’s mandate.

MARGARET BRENNAN: So a recession for you? Is it off the table?

GOOLSBEE:

No, look. You’ve seen the table at the FOMC committee –

MARGARET BRENNAN: –I know–

GOOLSBEE: –a huge table–

MARGARET BRENNAN: I know

GOOLSBEE: Everything is always on the table. When there’s possibility of recession. The last GDP growth number was higher than expected. So that was a that was one of the bright spots. But you always got to worry about every contingency. That’s the job of the central banker.

MARGARET BRENNAN:

I want to ask you as well about what’s happening with what people pay at the grocery store. The San Francisco Fed found that corporate markups, what some might call price gouging, are not a primary contributor to inflation. Do your economists agree?

GOOLSBEE:

Well, look this, this has turned into a campaign election kind of battleground. So I’m not–

MARGARET BRENNAN: –I’m not asking a political question–

GOOLSBEE: We’re not in elections business. I’m not going to get into that. I think that it’s worth remembering that there are dynamics at play that is over time, wages tend to move slower than prices. So if some shock hits, prices go up, then wages go up, then prices come down, then wages come down. And so if you look at any given moment, that markup sort of the difference between what’s happening to prices and what’s happening to costs that can vary a lot over the business cycle. So I just caution everybody over concluding from any one observation about markups.

MARGARET BRENNAN: Are tariffs inflationary?

GOOLSBEE:

It sounds funny to say. It depends what you mean by inflationary. Tariffs raise prices, but in terms of something that, inflationary is about the rate of growth of prices, a one time increase in costs will raise prices, but is not an extended inflationary thing. So whether you want to call that inflationary or not, they raise costs and they raise prices.

MARGARET BRENNAN

Austan Goolsbee, we want your perspective as one of the top economists in the country. I know you left politics behind, and I’ve made you a little uncomfortable by asking you some of these questions, but we want to bottom line it.

GOOLSBEE:

You’re the smartest in the business. Margaret, any time you want to talk Fed mandate, inflation or employment, I’m, I’m always, I’m always up for it.

MARGARET BRENNAN

All right. Austan Goolsbee, thank you for your time. We’ll be back in a moment.