Donald Trump was often accused of putting political pressure on the US Federal Reserve during his time as president and there are many who expect he’ll go further if he wins November’s election.

Towards the end of his administration, as the Covid pandemic shook the global economy, Trump frequently made it clear he was “not happy with the Fed” because it was “following” when “we should be leading”. He also dropped dark hints about his power to fire Jerome Powell, the boss of the supposedly independent central bank.

Democrats will never say it out loud, and Mr Powell’s job is safe, but many must be harbouring similarly dark thoughts about the Fed chief round about now. Markets around the world are being rocked by the kind of brutal sell-off usually reserved for a financial crisis amid fears the Fed has once again been caught napping.

Japanese stocks suffered their worst day since 1987 on Monday with shares plummeting by 12pc. European shares followed suit, falling to six-month lows, while Britain’s FTSE 100 suffered its worst drop in more than a year.

The trigger was weak jobs data on Friday, which suggested the US is heading for a recession. It follows the Fed’s decision to sit tight on its hands even though most of its counterparts around the world are busy cutting interest rates. The US added fewer jobs than expected. But, more worryingly, the unemployment rate rose to a three-year high of 4.3pc.

Labour market data are critical to assessing recession risks. As Neil Shearing, the chief economist at Capital Economics, says: “Weaker demand leads to less hiring and more firing, which feeds back into weaker demand, creating a vicious cycle that is only broken with policy support.”

At the moment that policy support is conspicuous by its absence. Bill Ackman, the hedge fund manager, tweeted on X, formerly known as Twitter, that the Fed was too slow to raise interest rates when inflation started to take hold following the pandemic and is now being too slow to lower them as the economy stutters.

The central bank appears to have backed itself into a corner with no good choices. Sit tight and it will compound the impression it’s dawdling; move and it will be admitting to an error. It’s hard at this point to know which might spook the markets more. The fact that there was some chatter on Monday about an emergency rate, the worst of all worlds, highlights quite how strung-out some nerves have become.

It’s hard to see how any of this bodes well for Kamala Harris. There’s still a debate to be had about the merits of Bidenomics, but it’s clear that many Americans blame the president for the high cost of living. The last thing Ms Harris needs ahead of November is the rising threat of a recession and every major index in the US flashing red.

For the time being, the vice-president has momentum. But the race for the White House is still incredibly tight. If things don’t settle down, she’s going to find it incredibly difficult to distance herself from the economic inheritance of the man whose endorsement sealed her place at the top of the ticket.

As always with the markets, there are lots of moving parts so it’s hard to parse definitive conclusions in real time. There are at least two reasons to suppose that the broader economic outlook is nowhere near as dire as the bloodcurdling falls would suggest.

The first is related to those particularly shocking movements in Japan. In a bid to prop up the yen, the Bank of Japan has started hiking interest rates. This has undermined the hugely popular carry trade, where investors borrow in the low-interest Japanese currency to make bets in higher-yielding currencies, especially the dollar.

With the yen now strengthening, the cost of maintaining these trades is becoming prohibitive. This has resulted in lots of investors selling off their holdings in US equities in order to repay yen-denominated debts.

That sell-off has been exacerbated by the fact that an enormous portion of recent gains has been concentrated in such a small handful of AI-focussed stocks. The total market capitalisation of the so-called “Magnificent Seven” rose from $12.3 trillion (£9.6 trillion) at the turn of the year to $16 trillion at the end of June.

This vast concentration of gains in so few stocks has made the stock market — both on the way up and now on the way down — an even worse gauge than normal of the real economy. Certainly, there’s plenty of real-time economic indicators that suggest the US remains in reasonable fettle.

Economists at Goldman Sachs raised their odds on a US downturn within the next year from 15pc to 25pc following the weak jobs data. In other words, the risk of a hard landing has increased, but there is still only a one-in-four chance of the US tumbling into a recession.

But what are the chances of Trump paying the slightest heed to any of these nuances? After all, the US wouldn’t actually need to be in a recession for him to make the argument that the outlook is worsening.

Brave is the person prepared to make a call on November’s election. In the past month alone we’ve had Biden’s disastrous debate performance, the assassination attempt on Trump, and the Democrats changing horses mid race.

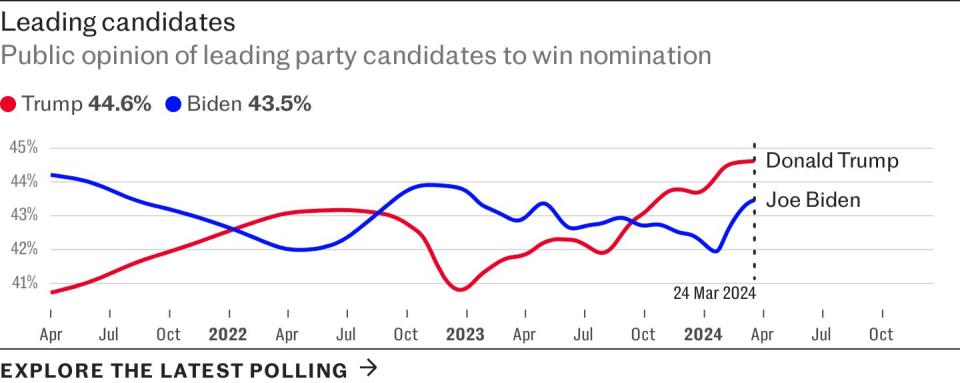

There has been a big reversal in sentiment in the past couple of weeks with Ms Harris overtaking Trump in the polls as voters breathed a sigh of relief that November won’t be the planned battle between a late septo- and early octogenarian.

But the Fed’s tardiness could now very easily flip sentiment back the other way. Buckle up, because there’s even more resting on this market correction than usual.